The global movement towards environmentally friendly transportation options has been a major driver of the electric vehicle (EV) industry’s rapid growth. Moreover, investors are looking for ways to profit from this expanding sector as the demand for EVs rises. However, the Best EV Stocks that are positioned to prosper in the changing environment of electric mobility will be discussed in this blog. These businesses, which range from major players to intriguing upstarts, are influencing the direction of transportation and offering fascinating investment opportunities.

Here Are Top 5 Best EV Stocks to Invest In:

| Company (Ticker) | Market Capitalization |

|---|---|

| Tesla Inc (TSLA) | $651 billion |

| NIO Inc (NIO) | $13 billion |

| Ford Motor Company (F) | $48 billion |

| General Motors Company (GM) | $46 billion |

| Li Auto Inc. (LI) | $29 billion |

TSLA Tesla Inc. (TSLA) – Market Capitalization$651 billion

NIO Inc. (NIO) – Market Capitalization $13 billion

The Ford Motor Company (F) – Market Capitalization $48 billion

General Motors (GM) – Market Capitalization $46 billion

Li Auto Inc. (LI) –Market Capitalization $29 billion

These are some of the best EV companies whose stocks you can avail of. Also, you can earn profit from them without any kind of risk. However, before making judgments about investments in the EV industry, investors should do extensive research, evaluate the market, and take their risk tolerance into consideration.

Why to Purchase EV Stocks?

EV stocks are intriguing to investors because of their growth potential and because they allow them to support sustainable businesses. Although stock investment shouldn’t be an emotional activity, it can be enjoyable to invest in companies whose products you support. Moreover, nearly all EV manufacturers want to improve the world through their technological advancements.

Steps to get started with EV Stock Investing

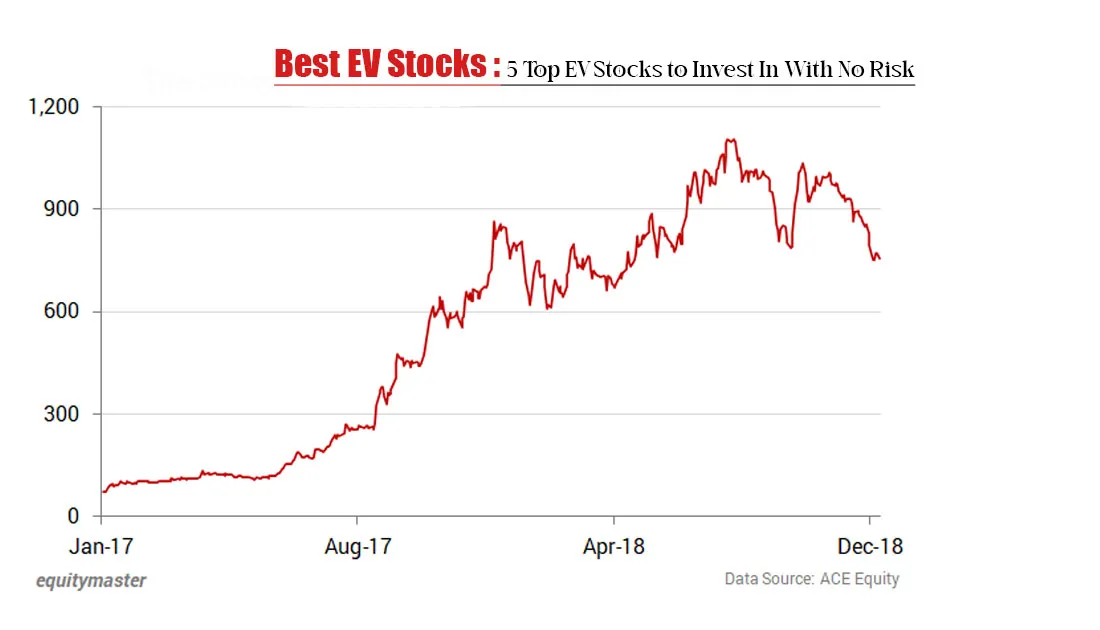

Electric vehicle stocks have experienced a negative increase of roughly 17% and 31% over the past year, respectively, according to indices such the Fidelity Electric Vehicles and Future Transportation Index and the S&P Dow Jones’ S&P Kensho Electric Vehicles Index. Since EVs are here to stay, price drops frequently offer excellent purchasing opportunities.

Methodology

The world of publicly traded EV equities is overflowing with tenacious entrepreneurs that are just a few years or even months out from their initial public offerings (IPOs), aside from some big-name companies like Tesla. Some of them won’t turn a profit for several years.

- Due to these factors, we mainly base our ranking of the top EV stocks on financial stability and sales growth. The equities must also fulfill the following criteria and be listed on a North American stock exchange.

- Market cap of at least $800 million: Due to the EV industry’s experimental nature and the volatility of tech stocks, we have restricted our list to businesses having a market size of at least $800 million.

Rise In Annual Sales:

In 2022, each company’s sales climbed by at least 10%.

- A Q1 2023 performance of at least 4%: Tech stocks have had a banner year thus far in 2023, and many EV companies have experienced significant growth. We restricted our search to businesses that were able to benefit from this windfall by increasing their stock price by at least 4% in the first quarter (which is equivalent to about 50% of the S&P 500’s gains).

The electric vehicle market is undergoing a radical transformation, and for investors looking to gain exposure to the expanding market, investing in the finest EV stocks might be a profitable option. Even if the aforementioned businesses are among the top contenders, it’s crucial to undertake extensive research, evaluate industry trends, and speak with financial experts before making an investment decision. The EV business offers an exciting path for investors wishing to get involved in the switch to cleaner transportation and make a positive impact on the environment as the world moves faster towards a sustainable future.

Wrapping up:

In the blog post above, you will come to know about the Best EV Stocks. However, if you seek a source in order to determine more information, you must take help from the blog post by referring to it. Moreover, you can also explore our website if you are wandering for more details on the same topic.