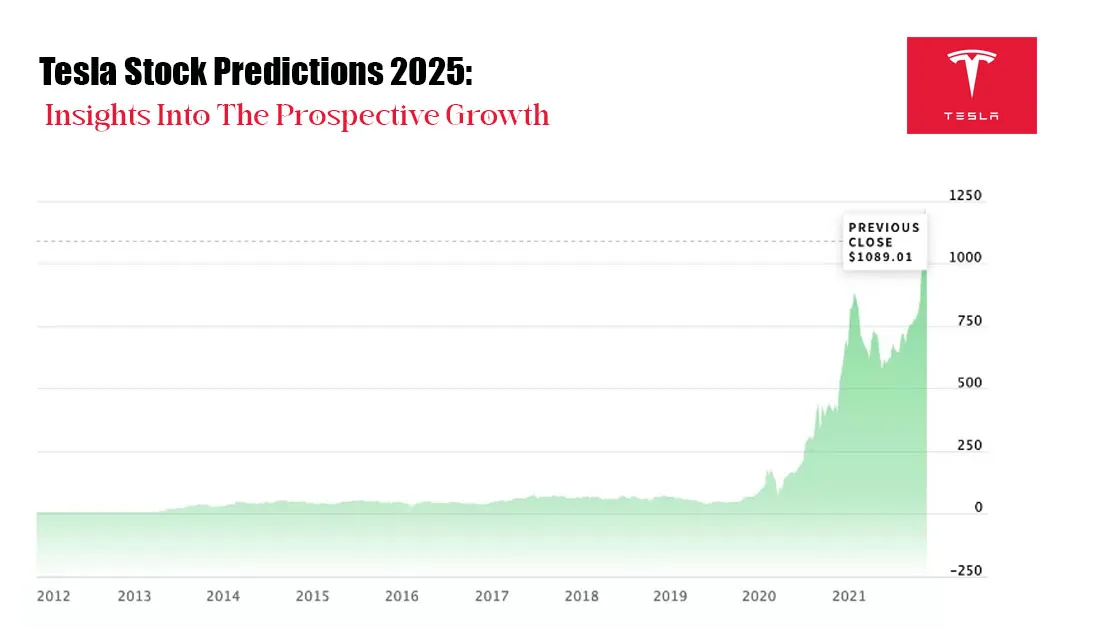

Tesla has become a key player in the growing and evolving electric car market due to its ground-breaking innovations and inspirational leadership. The future course of Tesla’s stock and Tesla Stock Predictions 2025 is passionately expected by both investors and fans. However, we are also going to examine the forecasts and elements that might affect Tesla’s stock performance in 2025 in this blog post. In addition to this, we will also seek to offer insights into the prospective growth possibilities and investment opportunities for Tesla in the upcoming years by analyzing key drivers, market trends, and industry dynamics.

Role of Market Expansion for Electric Vehicles in Tesla’s significant Growth

In the near future, the market for electric vehicles is expected to develop significantly due to government assistance, technological breakthroughs, and environmental concerns. However, Tesla is well-positioned to benefit from this sector’s expansion because to its track record of success and strong brand recognition. Also, the demand for electric vehicles is expected to rise in important areas around the world, such as the United States, Europe, and China. However, Tesla is expecting to acquire a sizable portion of this expanding market as it keeps innovating and increases its production capacity, which will boost stock performance.

How Is Innovation In Technology Contributing In Rise Of Tesla’s Stocks?

Tesla’s dedication to technology improvements and product innovation is mainly responsible for its success. However, key competitive advantages for the company in the industry are its ongoing advancements in battery technology, autonomous driving capabilities, and energy storage solutions. In 2025, we may anticipate Tesla to develop its product line even further by releasing new models with longer ranges, quicker charging times, and more safety features. Furthermore, these technological developments may boost investor trust and support Tesla’s stock rise when coupled with the company’s first-mover advantage.

The potential for long-term growth of Tesla is greatly influenced by its intentions for global expansion. However, tesla plans to enter new markets and cut costs by developing manufacturing facilities in key places, such as the gigantic factories in China and Europe. Currently, Tesla can reach a wider client base and efficiently bypass trade restrictions thanks to their expansion approach. Tesla anticipates having a boom in sales and revenue, favorably affecting the performance of its stock, as it continues to establish its market position and expand its presence in emerging areas.

Know Policies Of The Government And The Regulatory Environment

Government rules and policies have a big impact on Tesla’s stock performance as well as the electric vehicle sector. In recent years, numerous governments around the world have put in place beneficial policies to encourage the adoption of electric vehicles, including tax incentives, subsidies, and higher pollution requirements. These regulations encourage the purchase of Tesla cars and foster an environment that is favorable to the company’s expansion. Tesla’s stock trajectory, however, might be impacted by modifications to rules or the adoption of new policies. For Tesla to continue to succeed, it will be essential to track and adjust to changing regulatory environments.

How to Interpret Tesla Stock Charts and Predict Prices?

For investors, having a solid understanding of how to interpret Tesla stock charts and anticipate price changes can be extremely beneficial. The following are crucial methods and tools for technical analysis:

- Different Stock Chart Types: You should first learn how to read line charts, bar charts, and candlestick charts to see price patterns, trends, and levels of support and resistance.

- Moving Averages: To see trends and prospective buying/selling opportunities, use moving averages like the 50-day and 200-day moving averages. Moving average crossovers can indicate changes in momentum.

- Relative Strength Index: To determine whether a stock has reached saturation or overpriced, you will have to use the relative strength index (RSI). However, stock price and RSI divergences can point to probable trend reversals.

- Support and Resistance Levels: You will have to locate significant levels of support and resistance on the stock chart of Tesla, since they can point to locations where there is pressure to purchase or sell. These levels may be broken through or broken through to indicate price change.

- Volume Analysis: All you will need to do is to keep an eye on trade volume as it might confirm price changes and show market activity.

What Are Significant Variables Affecting Tesla Stock Predictions 2025?

Like any other stock, the price of TSLA stock is impacted by a number of variables. The following significant variables can affect the price of TSLA stock:

- Performance of the Company: The stock price of Tesla may be significantly impacted by the company’s financial performance, which includes its revenue, profitability, and prospects for future growth. Positive performance can result in a rise in the stock price, whereas unfavorable reports on earnings, robust sales numbers, and successful product launches can result in a fall.

- Investor Speculation and Short-Term Trading: Investor speculative actions, short-term trading, and market manipulation may result in brief changes in the price of TSLA stock. Stock volatility can be influenced by rumors, analyst reports, and trading patterns, among other things.

There are inherent risks when predicting the stock performance of any company, even Tesla. However, investors can get important insights by looking at significant factors, market patterns, and using technical analysis tools to understand stock charts and estimate price moves. Moreover, a complete picture of Tesla’s growth potential may be obtained by comprehending the rapidly growing electric vehicle market, technological developments made by the company, intentions for international expansion, and the impact of governmental regulations.

Conclusion:

In the end, a careful examination of numerous variables can help investors make wise decision regarding their Tesla Stock Predictions 2025. For additional support and information about the same, you must check out our website at any time.